Must-Know Mortgage Tips with Matthew Clarke!

When we decided to launch a blog, the goal was to share practical tips for people trying to navigate the real estate industry, introduce you to industry professionals who may be able to assist you along your journey, while simultaneously bolstering our SEO strategy. Well, we may need to come up with something more challenging, because we have knocked that goal out of the park with the calibre of our first two contributors!

Matthew Clarke is a Mortgage Agent, Financial Consultant, and all-around good guy to know, who has been providing professional advice to Canadians since 2007. True to form, Matthew has partnered up with Prelist on this post to deliver three key mortgage considerations when buying your next home.

- The right down-payment:

- The right type of mortgage:

- The importance of an underwritten pre-approval:

Home buyers in

Canada

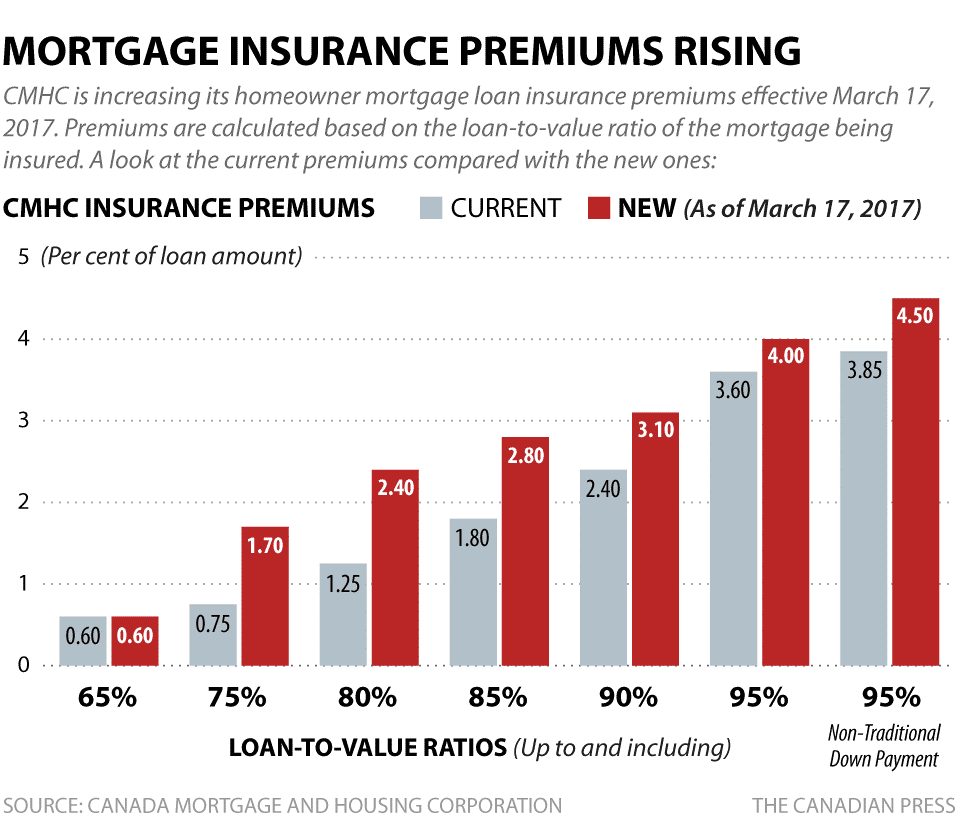

are required to make a down-payment of at least 5% of the purchase price of the property. But remember, anyone that has less than 20% down-payment is required to pay a

CMHC Premium

, which is the cost of insuring your new mortgage against default (non-payment of the loan). With only 5% down, the CMHC Premium will be 4% of the total loan amount. For a $300,000 mortgage, that would be a $12,000 premium. So, what’s the upside of paying for this premium? It usually results in the home buyer having a lower interest rate on the loan, which could save them money over the long-term.

When speaking about mortgage rates, most people in Canada refer to the 5-year fixed rate. Currently, the

Bank of Canada

quotes the 5-year mortgage rate at 5.14%, even though most Canadians can negotiate lower rates than this from a lender. Borrowers are free, however, to negotiate a range of mortgage terms, including anything from an “open” mortgage, which allows the borrower to pay off the balance of the loan at any time, to a 10-year mortgage, which locks in the client’s interest rate for 10 years, with the consequence of paying a penalty should the client choose to pay off the balance of the mortgage before that time is up. For borrowers that believe market interest rates might stay the same, or even drop, a variable rate mortgage might be appropriate. Variable rate mortgages allow borrowers to borrow money at a lower rate than the current 5-year fixed rate, but with the condition that if market rates rise, so will the interest rate of the client’s mortgage.

With all of the recent changes to mortgage rules in

Canada,

it is important for home buyers to carefully obtain the right pre-approval before agreeing to buy a home. An underwritten pre-approval means that a professional took the time to ask for, and validate, several key documents that lenders and the government require from borrowers before they can grant them a mortgage loan. These documents might include employment letters, pay-stubs, credit reports, savings account statements, and even

Notice of Assessments from Revenue Canada.

These documents are meant to ensure that borrowers have consistent and stable income, that they can afford the mortgage over the long-term; they now even seek to ensure that the borrower could continue to pay the mortgage if interest rates rose a couple of percent. Many lenders will issue pre-approvals without asking for key documents, and this could leave the client open to the risk of not actually being able to obtain the mortgage later in the process once the key documents are properly reviewed.

The sweet sound of good advice. If Matthew’s wise words have struck a chord in your home-buying heart, feel free to follow-up with him directly:

Matthew Clarke, BA (Hons.), B.Ed., MBA

Mortgage Agent and Financial Consultant

|

[email protected]

|

www.ygkmortgages.com

Thank you to Matthew Clarke for stopping by, and happy home-buying!